Rally @ Flagstar’s Dearborn Heights (MI) Branch

Saturday, June 16, 11 am – Noon

26545 Ford Rd. (Half mile east of Inkster Rd.)

Call Flagstar Bank, 248-312-2000.

Flagstar claims to be a “community” bank and a Michigan company, but it is actually owned by MatlinPatterson Global Advisors, a New York equity firm that Forbes Magazine recently described as a leading “Vulture Investor,” known for “picking the bones of crumbling companies.”

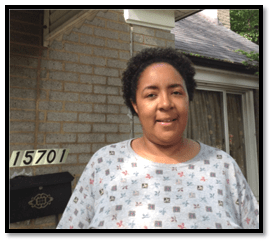

Jennifer Britt knows what that means. Since her husband died in 2006, she has paid more than $40,000 to Flagstar to save her family’s home in Detroit’s Rosedale Park. She lost her job in 2008 but continued paying rising monthly payments that took her entire savings. Flagstar foreclosed in 2010 and sold the mortgage to Fannie Mae. Eviction is imminent.

Jennifer now has a job and could make reasonable mortgage payments if Flagstar and Fannie Mae agreed to work with her. State and federal programs call for mortgage modifications to keep people in their homes. There is no good reason why Jennifer and her family should be evicted, leaving another vacant house in Detroit.

Flagstar is the Deadbeat, not Jennifer. The bank was assessed $133 million in fines by the federal government this year for fraudulent loan practices stretching back over a decade. Flagstar has yet to pay taxpayers back for the $267 million bailout it took in 2009.

Call Flagstar Bank, 248-312-2000. Tell Joseph Campanelli, CEO, to help Jennifer Britt and her family keep their home. The bank held the mortgage from 1999 thru the sheriff’s foreclosure auction. “Nationstar Mortgage” or some other related entity may have briefly serviced the loan before Fannie Mae compensated the bank with taxpayer money. Flagstar can take back the mortgage from Fannie Mae and modify the loan. Other banks have done the same after public protest.

Contact us at: DetroitEvictionDefense@gmail.com

###

You must be logged in to post a comment.